Several DeFi companies offer the ability to lend and stake your crypto to earn interest. At the time of writing, there is more than $14 billion invested in lending companies like Compound, Maker and Aave.

Just as staking, lending and borrowing disrupted the DeFi ecosystem, these same mechanics are being implemented in the NFT space.

NFT staking is used by platforms to provide extra utility and passive income to holders. NFT staking lets holders lock their assets in DeFi platforms to receive rewards. All without the need to sell their NFT collections.

PermalinkWhat is NFT Lending?

According to NFTNOW, NFT lending is the act of collateralizing your NFT as a loan in exchange for immediate crypto payment. And it solves the asset class’ most significant problem: liquidity.

Relative to other asset classes, NFTs are relatively illiquid — meaning it’s not easy to quickly sell your NFT for its designated market value in cash (or cryptocurrency). In other words, it can take months for someone to buy your JPEG.

PermalinkHow Does NFT Lending Work?

Platforms that allow NFT loans allow holders to borrow funds and set terms without any intermediary by putting up their asset as collateral — NFT as in this case.

The lender provides liquidity to the holder in exchange for interest. But if the borrower cannot repay the loan on agreed terms, the loan obligation goes into default and the lender gains full access to the NFT collateral. In most cases, this process is autonomously executed by smart contracts on the blockchain.

The process of NFT lending and borrowing is executed through on of two main models both of which has its own pros and cons:

PermalinkPeer to Peer

This is the easiest and the most straight forward model. It replicates the classic model of lending marketplaces. Peer to peer platforms allows anyone to create loans for different NFT collections and set their terms to receive loan offers without any centralized or third party.

As part of the loan agreement, the platform automatically transfers your NFT into a digital vault — an escrow smart contract — for the duration of the loan.

You get your NFT back into your wallet when you repay the loan before the expiration date. If you default on your loan, the lender will receive your NFT at a huge discount. One of the best aspect of this model is you get flexibility with setting terms for your loan

PermalinkPeer to Protocol

This model gives users the chance to interact directly with the liquidity pool, rather than relying on a borrower or lender to accept your terms like the peer to peer model.

Similar to DeFi lending protocols, these NFT lending platforms rely on liquidity providers adding crypto funds to a protocol pool. Borrowers can access liquidity immediately after collateralizing their NFTs and locking them up in the protocol’s smart contract-powered digital vaults.

It is through these models that borrowers can access instant loans because of the ready liquidity available in the liquidity pool.

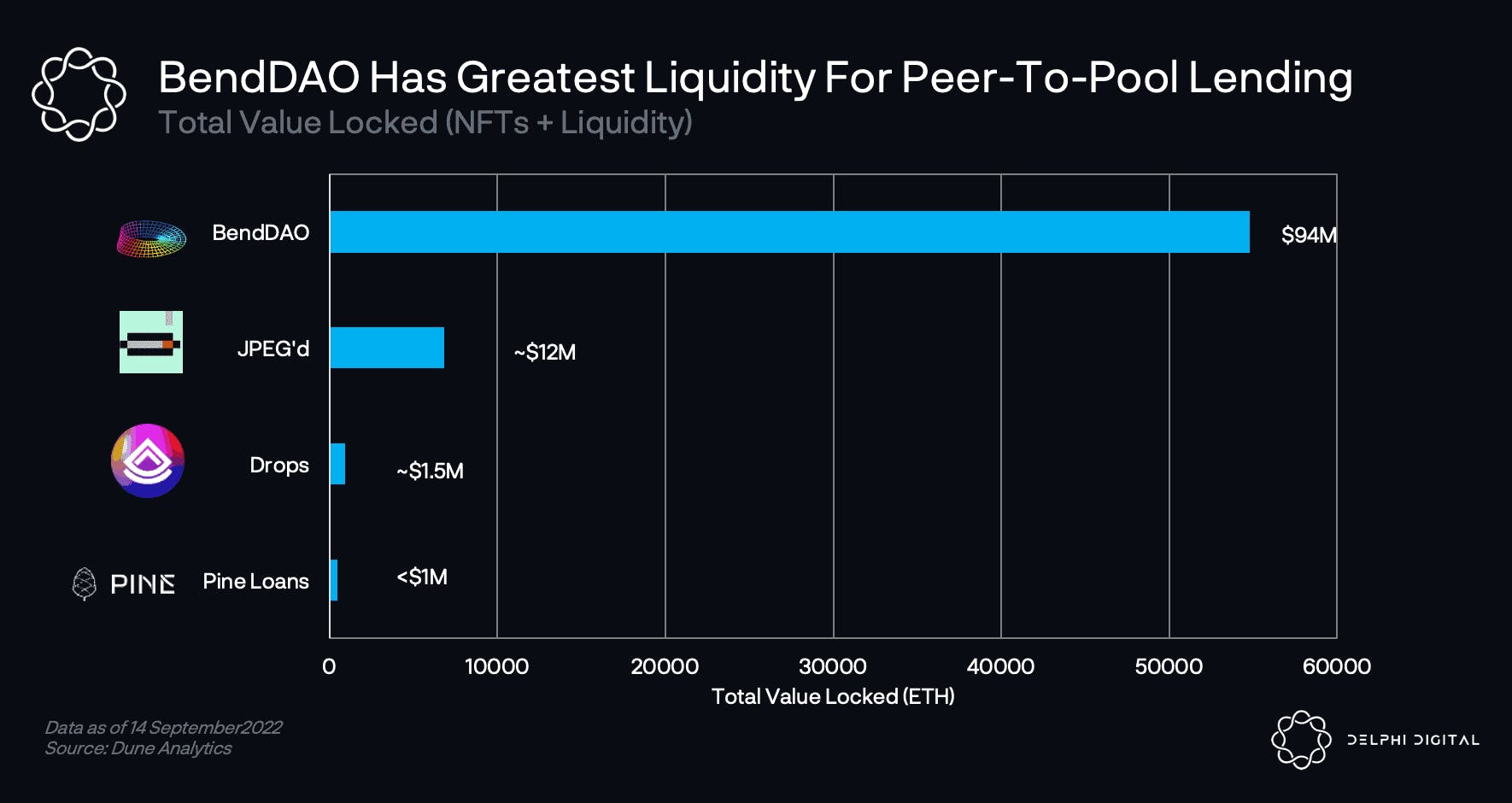

Though peer to protocol is still unproven and experimental, there has been increasing attention lately.

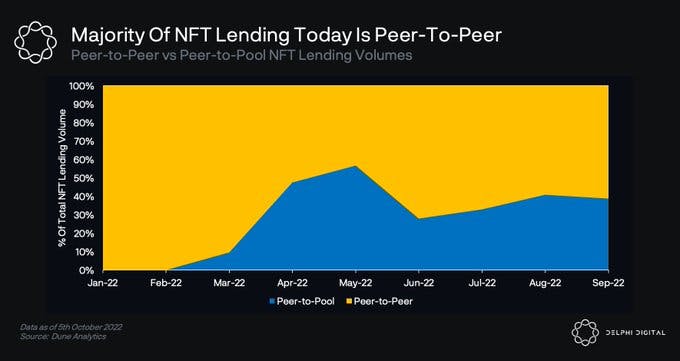

Here is a comparison on the volume between peer to peer and peer to pool models in 2022 made by Delphi Digital

PermalinkNFT Platforms You Can Get Started With

PermalinkNFTFi

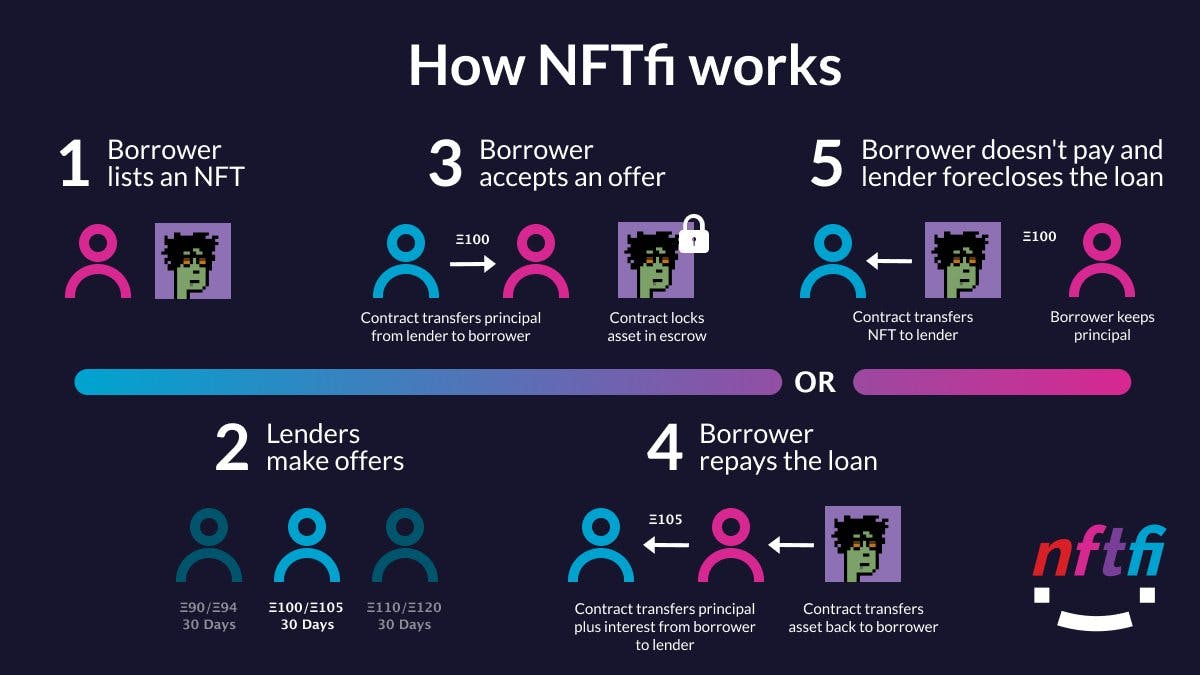

NFTFi is a peer-to-peer NFT lending protocol, where borrowers collateralize their NFTs and receive loans from lenders — thus allowing borrowers to unlock liquidity for their NFTs.

NFTFi allows NFT owners to use their assets to access the liquidity they need by receiving secured wETH and DAI loans from liquidity providers, in a completely trustless manner. NFT liquidity providers use NFTfi to earn attractive yields or — in the case of loan defaults — to have a chance at obtaining NFTs at a steep discount to their market value.

PermalinkPine

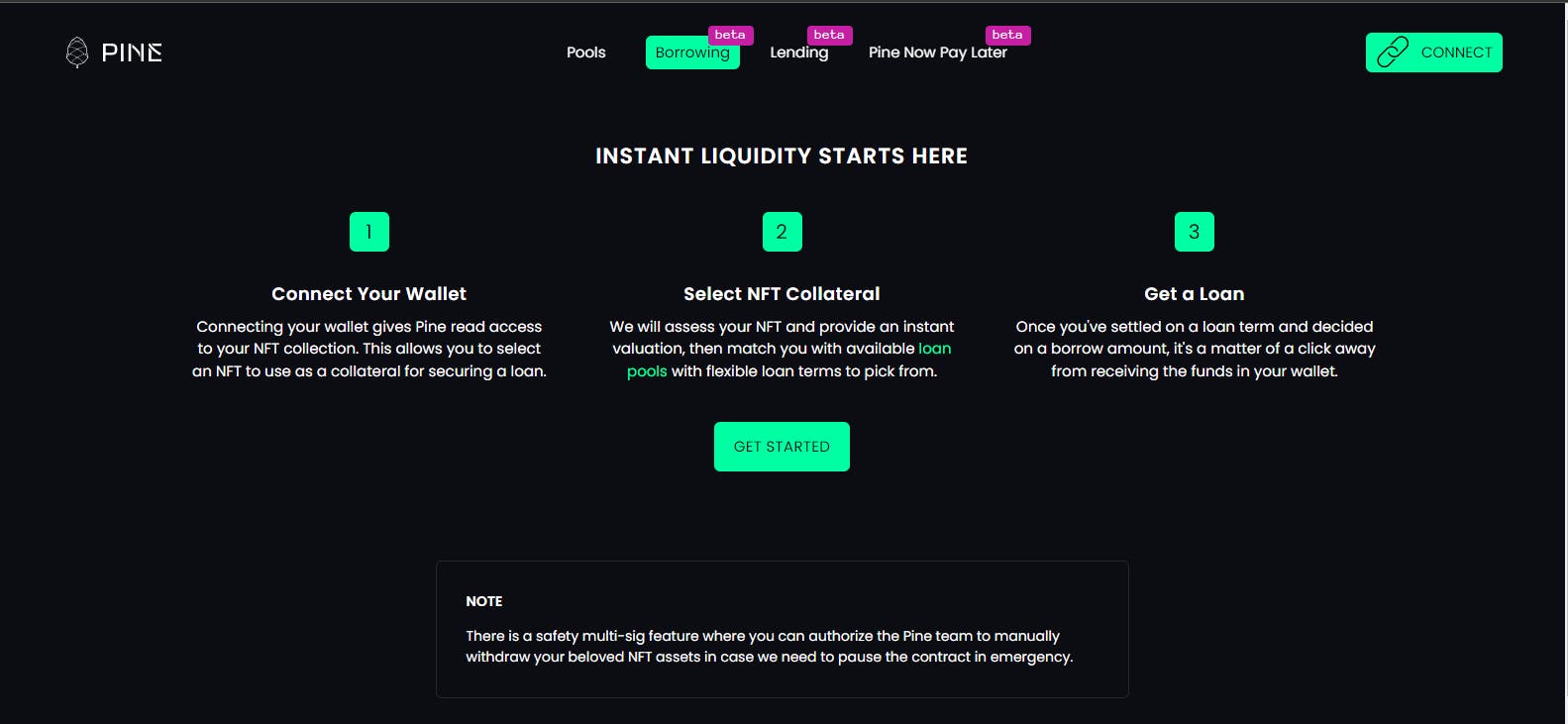

Pine is currently a peer to peer lending platform with plans of transitioning into an intersection of peer to peer and peer to protocol model. It is a platform for multiple lenders to list their loan offerings and allows NFT holders to initiate and extend loans with the best terms available on the market.

In the back, the platform operates similar to an exchange that provides an offer book structure and guarantees enforceability of the terms.

When a loan is initiated on the Pine Protocol, the terms and conditions for the loan are defined in a smart contract and the NFT collateral is deposited into the same smart contract.

The smart contract is between the borrower and the lender and depending on different conditions, either party would have the rights to take ownership of the NFT collateral asset.

As the protocol is designed to be decentralized and non-custodial, no one besides the borrower and lender would have access to withdraw the NFT from the smart contract.

PermalinkBendDAO

BendDAO is the first decentralized peer-to-pool based NFT liquidity protocol. NFT holders are able to borrow ETH through the lending pool using NFTs as collateral instantly, while depositors provide ETH liquidity to earn interest.

The leveraged NFT trading is built on instant NFT-backed loans.

To assign value to the collateralized NFTs, BendDAO uses Chainlink oracles to obtain floor price information from OpenSea and then allow users to instantly access a set percentage of their NFTs floor price as an NFT-backed loan. The NFT is then simultaneously locked within the protocol.

PermalinkConclusion

There are a lot of options to choose from when it comes to NFT lending and borrowing. However, remember that financial investment in NFTs and DeFi – or the intersection of both as in this case – presents a myriad of risks, including sudden downturns in the cryptocurrency market, smart contract exploits and regulatory crackdowns.

Although many of these platforms are audited, an audit doesn’t guarantee safety, it only points out the errors in a platform’s code as far as the auditor can spot. However, employing caution, being security conscious, and adopting the best NFT lending practices can prove very beneficial and financially rewarding.